City Reserves Drop into the Red Zone

Reserves are the black box of Ottawa city finances. Budget 2025 shows them dropping below recommended levels.

This is the second of some short commentaries on the 2025 Ottawa Budget that I will be publishing for paid subscribers. If you are not already a paid subscriber but value this work, I would be grateful for your support.

Since Mark Sutcliffe’s first budget, I have been banging the drum about the level of reserves at the City of Ottawa.

Reserves are our “rainy day funds”, to cushion us against unexpected shortfalls in revenues or increases in costs.

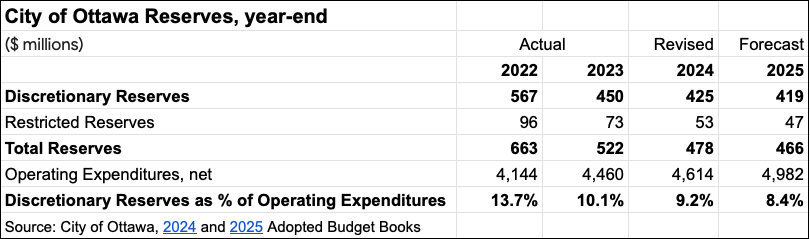

The table below is what our reserve balance will look like, according to the latest budget documents. Total reserves will drop from $663 million when Mark came to office to $466 million by the end of 2025 — a 30% drop.

What level of reserves is required?

How much do you hold in a rainy day fund? Financial advisors would suggest 3-6 months worth of expenses.

How much should a city hold?

The City policy sets the target levels for different categories of reserves. But these targets are arithmetic calculations that mean little to anyone. Furthermore, determining whether we are meeting these targets is impossible for anyone outside of City Hall to calculate.

In addition, the City doesn’t actually provide any reporting on whether our reserve balances are at the right level or not.

The MO seems to be “trust us. We’ll tell you if there’s a problem”.

One simple number

It doesn’t have to be complicated. Councillors have a fiduciary responsibility, and that includes whether we are managing reserves responsibly.

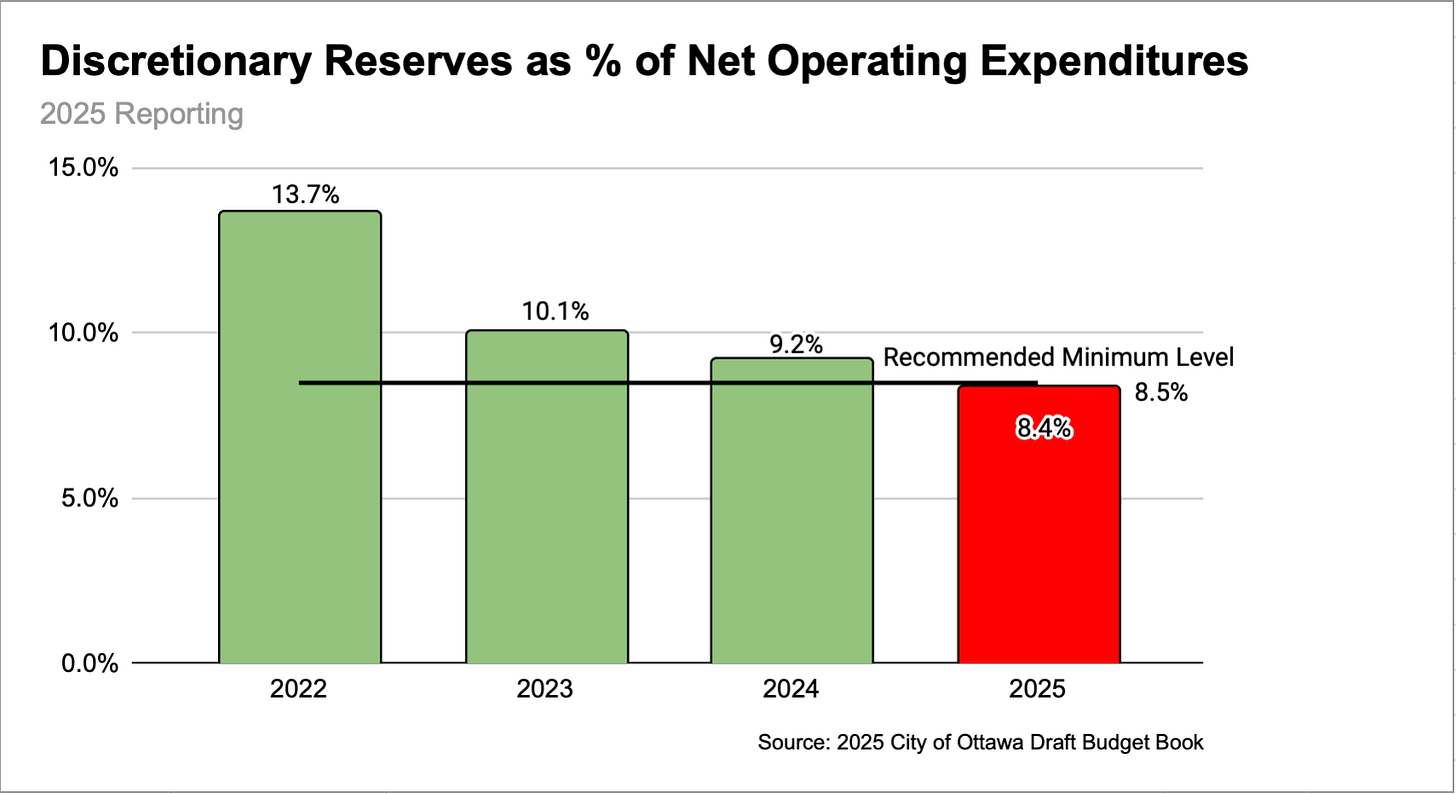

Our entire reserves policy could be boiled down to one number. Indeed, the City’s reserves management policy includes the staff recommendation that discretionary reserves amount to no less than 8.5% and no more than 12% of operating expenditures.

That could be the entire policy.

Hold discretionary reserves equal to 8.5% to 12% of operating expenses.

Reserves can be made a lot more complex. But that may be complexity for the sake of complexity. Despite what finance officials may say, it doesn’t do a whole lot to improve our ability to manage risk.

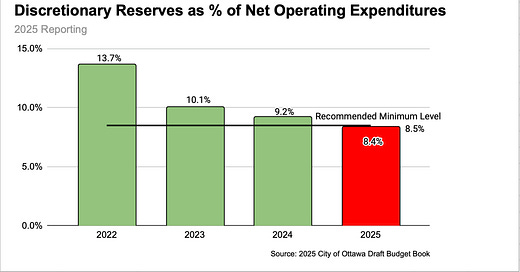

2025 data

The City doesn’t report on the ratio of discretionary reserves to operating expenses. But it provides both those numbers.

I’ve calculated that ratio dropping to 8.4% by end-2025 — below the City’s recommended minimum level.

In the 2025 budget, the City also updated its previous projections for 2024 reserve balances. The City is now projecting that our total reserve balances at the end of this year will be $59 million better than they were projecting in the spring. That’s good news. In last year’s budget, the City was projecting that we would drop below the 8.5% level by end-2024.

So what?

Reserves are the black box of city finances.

And they have been falling throughout Mark’s time in office.

A case can be made that Sutcliffe was able to keep tax increases below the rate of inflation during his first two years by dipping into reserves. Without big cuts to services, it’s hard to see how else the math works.

But the bigger issue is transparency. The analysis here presents a simple framework for understanding what level of reserves is required.

Why can’t the City present reserves in a manner that anyone can understand?

They could. Just like the “3-6 months of expenses”, this does not have to be complicated.

But maybe City staff do not want to make reserves transparent.

If there was transparent about reserve balances, councillors might start making claims on how to spend any excess money.

If city staff are the only ones who know whether we have too many, too few or just the right amount of reserves, then staff are the only ones who can authorize dipping into those funds.

But it is our elected officials who are ultimately accountable. Councillors, and the public that they report to, should have full transparency on how reserves are managed.