Will Taxpayers Subsidize $4 Billion in Tewin Developer Profits?

Another sweetheart deal for developers

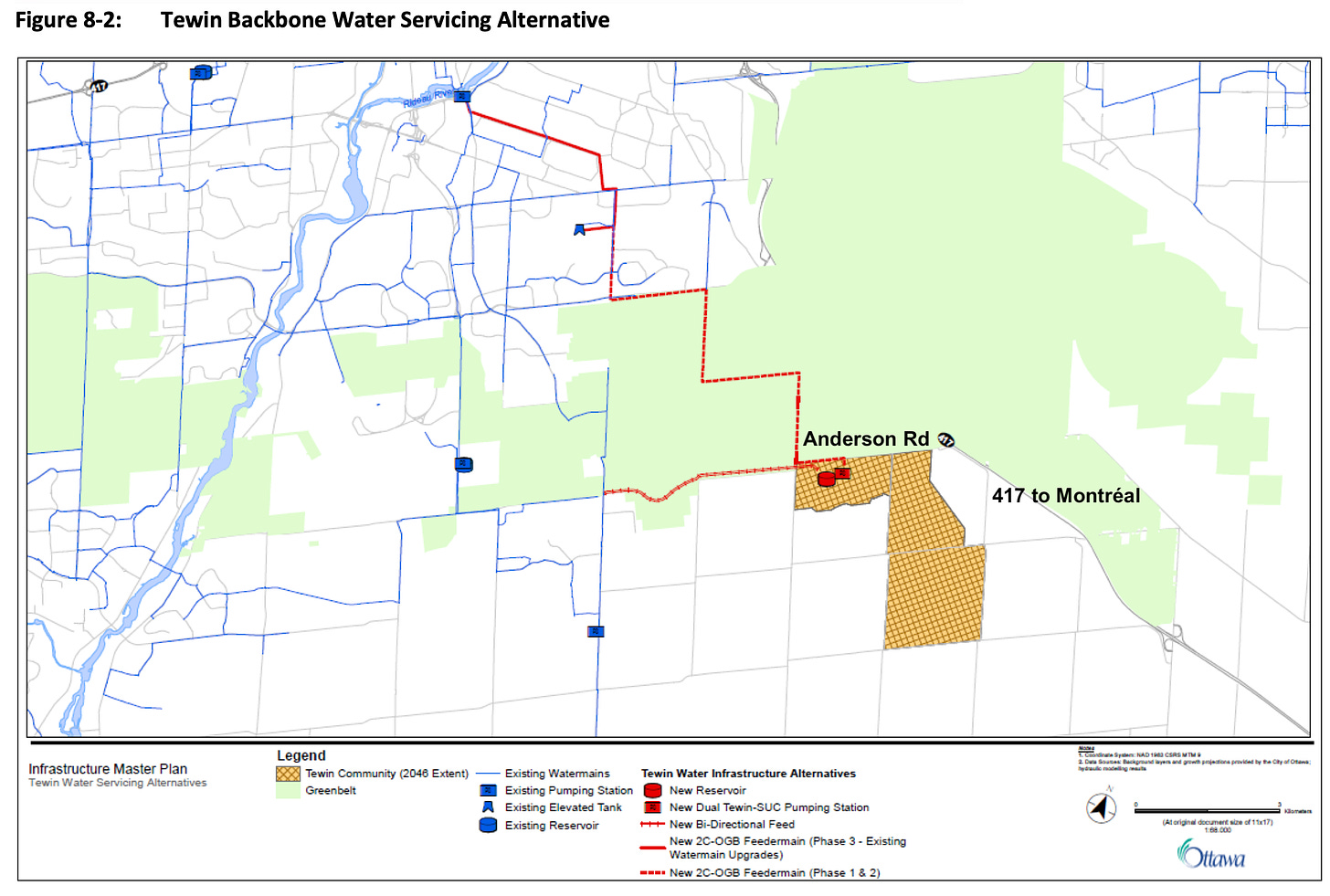

Tewin is a parcel of land in the south of Ottawa. Head south-east on the 417 towards Montréal, cross the greenbelt, and get off at Anderson Rd — one stop before the Amazon fulfillment centre. In the map below, it’s the bit in yellow.

This article is not about Tewin’s checkered past.

How this parcel of land was added into the urban boundary at the eleventh hour over the objection of staff.

How the land owners chainsawed a forest in the middle of the night.

How indigenous groups are outraged that this is considered an act of reconciliation.

This article is about the money.

Tewin does not pay for Tewin

We were always promised that Tewin would pay for Tewin. That will not be the case.

We’ll be subsidizing Tewin in the short, medium, and long term.

In the short term, the key question is whether the new homes in Tewin will pay for their growth costs through development charges that reflect the full cost of that growth.

Infrastructure Master Plan

The big cost for Tewin is getting water and sewage pipes across the greenbelt. The two red lines in the map below.

As per the draft Infrastructure Master Plan that the city is considering, those two sets of water and sewer pipes will cost $596 million.

It turns out that building pipes across the greenbelt is expensive.

What $596 million pays for

Pipes to service the approved Tewin lands inside the urban boundary (the yellow area) cost $408 million. That will serve about 7,200 homes.

Pipes to service the potential future Tewin lands that are currently outside the urban boundary cost $170 million. That would serve a further 33,000 homes.

These additional lands are known as the “South Urban Community”. The SUC is the west (left) of the yellow area and likely to the south also.

As the SUC lands do not fall within the urban boundary, developers do not currently have the right to build homes there.

(Eagle eyed readers will wonder about the balance; there is also $17 million which is “Benefit to Existing” and charged directly to current customers).

$408 million for Tewin lands inside the approved urban boundary.

$170 million for possible future Tewin lands that are outside the urban boundary.

Development charges

I’ve written previously about development charges. It is one of my more important articles. Development charges are the fee levied on each new construction, in order to pay for infrastructure costs (roads and pipes) as well as services (police, libraries, parks, etc…) over 10 years. For a new home built outside the greenbelt, that one-time fee amounts to $58K per home.

Rising DCs in Ottawa are the Canary in the Coal Mine for Future Tax Increases

DCs are obscuring the real issue This week, Ottawa City Council approved an increase in development charges — the $50K or so that City Hall levies on new home construction to pay for growth. DCs pay for hard infrastructure, such as roads and sewers. They also pay for soft services over the following decade, such as fire, police and libraries.

For Tewin to pay for Tewin, they would have to pay the full cost of their growth through development charges.

So how much is that?

$408 million for water and sewer to 7,200 homes is $57K per home.

But water and sewer is only supposed to account for $12K of DCs. There is another $45K for roads and other services.

So the correct development charge cost for Tewin would be $103K per home.

The City’s Plan has pencilled in a $44K Area-Specific Development Charge, plus a City-Wide DC, for Tewin. But we don’t know yet how much that City-Wide DC will be.

If the total DC is less than $102K, taxpayers are making up the difference.

That is the first way in which Tewin would not pay for Tewin.

Paying for the SUC

In the medium term, the key question is who is paying the $170 million for the SUC — the possible future Tewin lands that are currently outside of the urban boundary and out of scope for development.

Over the next few decades years, you will.

The City will take on debt, financed by your taxes, to pay for it.

If, and only if, a future Council approves an expansion of the urban boundary, could the City charge that money to future home buyers through DCs.

But it’s not even clear if those future buyers will be the buyers of the new Tewin homes. They might be new buyers city-wide, or new buyers anywhere outside the greenbelt.

We just don’t know at this point. There is no guarantee those lands will ever be developed.

For sure you are going to pay for the $170 million over the next few decades. Whether that gets picked up by someone else in 30, 40 or 50 years is not really of much concern to taxpayers today.

Structural deficit after first 10 years

The long-run costs of Tewin are the most burdensome.

The City’s DC analysts, Hemson Consulting, calculated that new suburban developments bring in less in tax revenue than those communities require in city spending. The structural deficit amounts to $465 per person per year.

That shortfall is subsidized by taxpayers across the city.

In the case of Tewin, the first 7,100 homes will require that you and I and everyone else contribute $8 million a year to servicing that community.

Building the full 40,000 Tewin homes would amount to a $43 million a year subsidy from the city. Equivalent to a 2% property tax increase.

Profits to be made

Private businesses exist to make profits. That’s true for builders. And there is nothing wrong with that.

The Tewin developers can expect to make about $686 million in profit on the first 7,100 homes, assuming a 15% profit margin on the average Ottawa home price.

If the community were fully developed, the Tewin developers could expect to make about $4 billion in profit on the full 40,000 homes.

Risk should be rewarded. But should taxpayers be subsidizing $4 billion of potential developer profits?

Unfortunately, it looks like that is what is happening here.

Taxpayers would subsidize the growth costs of every new Tewin home, unless Council decides to levy a $103K development charge on each construction.

Taxpayers would be on the hook for $170 million for the next few decades, and possibly forever.

And taxpayers would pay another $42 million a year once the community is fully up and running, equal to a 2% property tax increase.

A better way

There is an alternative.

We could build new homes inside the existing urban boundary, and especially as infill in already built-up areas.

Infill doesn’t require a lifetime subsidy from all other taxpayers. Every new infill home generates $606 per person per year more in property taxes than it requires in spending. Infill can save us from future tax increases. Infill could lead to tax reductions.

I wouldn’t want my tax dollars used to subsidize a few new billionaires in Ottawa. I’m guessing you wouldn’t either.

UPDATE 23/08

A reader brought to my attention that there was a misinterpretation in this analysis. It comes down to whether Development Charges pay for the first 10 years of infrastructure capital costs, or both the infrastructure capital and operating costs.

I checked with the experts and the first of those two interpretations is correct. The revision is not material to the basic argument of this note, but I wanted to be transparent that there have been edits to this note to incorporate the revised understanding of Development Charges.